Introduction

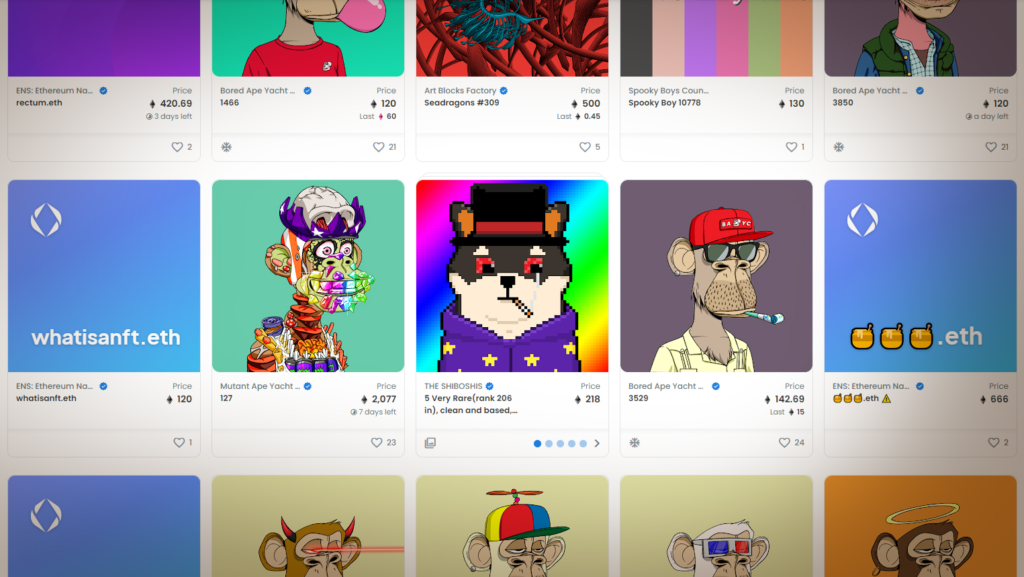

Non-fungible tokens (NFTs) have become a buzzword in recent years, attracting attention from investors, tech enthusiasts, and even artists. These unique digital assets, verified using blockchain technology, have created a new paradigm in digital ownership. While NFTs have been criticized for their volatility and speculative nature, they often outperform certain other investment assets in terms of value retention. This article delves into the reasons why some assets Devaluates Faster Than NFTs and the factors contributing to their rapid depreciation, offering insights to help you make better investment decisions.

Understanding Depreciation in Investments

Every investment carries an inherent risk of depreciation, the gradual loss of value over time. However, the speed and extent of this depreciation vary significantly depending on the type of asset. To understand why some investments lose value more quickly than others, it is important to explore the following key factors:

- Market Demand: Assets that are in high demand tend to retain their value better. Conversely, those with niche or declining appeal are more prone to rapid depreciation.

- Intrinsic Value: Tangible assets or those with functional use often hold their value longer compared to purely speculative assets.

- Technological Obsolescence: Rapid advancements in technology can render certain assets obsolete, significantly reducing their market value.

- Liquidity: The ease with which an asset can be bought or sold plays a crucial role in determining its ability to retain value.

By examining these factors, it becomes evident why some tangible and intangible assets Devaluates Faster Than NFTs, which benefit from a unique blend of scarcity, hype, and utility.

Case Study: Assets That Devaluates Faster Than NFTs

Electronics

Electronic gadgets are a prime example of assets that Devaluates Faster Than NFTs. Here’s why:

- Rapid Technological Advancements: The tech industry is constantly evolving, with newer, more advanced models introduced every few months. This makes older devices less desirable, even if they are still functional.

- Limited Lifespan: Electronics often have a finite lifespan due to hardware degradation and software incompatibility, further accelerating their depreciation.

- Depreciation Timeline: A smartphone, for instance, can lose up to 70% of its value within the first year of purchase. In comparison, NFTs—though speculative—can sometimes experience appreciation due to market demand, unique properties, or added utilities.

Fashion and Apparel

The fashion industry is another sector where assets devalue rapidly. While luxury brands like Chanel or Hermès may hold their value or even appreciate, most clothing items lose resale value quickly because:

- Seasonal Trends: Fashion trends change with the seasons, making certain styles obsolete almost as soon as they debut.

- Wear and Tear: Unlike NFTs, which are digital and cannot physically deteriorate, clothing is subject to wear and tear that diminishes its resale potential.

- Market Saturation: The rise of fast fashion has flooded the market with affordable options, reducing the demand for pre-owned apparel.

Vehicles

Vehicles, especially new cars, are notorious for rapid depreciation. Here’s why:

- Immediate Devaluation: A new car loses an average of 20% of its value the moment it’s driven off the dealership lot.

- Ongoing Maintenance Costs: Rising costs for maintenance and repairs further reduce the resale value of cars over time.

- Market Saturation: The automotive market is saturated with options, both new and used, which drives down the value of individual vehicles.

Unlike NFTs, whose value is often tied to rarity and market sentiment, vehicles face a consistent decline driven by tangible wear and economic factors.

Why NFTs Hold Value Longer (In Some Cases)

Scarcity and Rarity

NFTs derive much of their value from their uniqueness. Blockchain technology ensures that no two NFTs are identical, making them scarce digital assets. This scarcity often shields them from rapid devaluation.

Community and Utility

Many NFTs are backed by strong communities and come with additional utilities, such as access to exclusive events, games, or services. These added benefits enhance their perceived value and create a loyal user base.

Speculation and Hype

While speculative value can be risky, it also allows NFTs to surge in value quickly. This speculative element, combined with market hype, often offsets initial depreciation and makes NFTs an intriguing investment option.

How to Protect Your Investments from Rapid Depreciation

To avoid assets that Devaluates Faster Than NFTs, consider adopting the following strategies:

Diversify Your Portfolio

Diversification is key to minimizing risk. By spreading your investments across different asset classes, you reduce the impact of losses in any one area.

Research Market Trends

Stay informed about market dynamics and emerging trends. Understanding what drives demand and value can help you make educated investment decisions.

Focus on Long-Term Value

Invest in assets that have proven intrinsic or lasting value. Real estate, index funds, and blue-chip NFTs with strong community backing are good examples.

Monitor Maintenance Costs

For physical assets, factor in maintenance costs and other expenses that might accelerate depreciation. Proper upkeep can help preserve the value of certain tangible assets.

Stay Updated on Technology

If you’re investing in tech-based assets, ensure you stay updated on technological advancements and shifts in consumer preferences. This can help you anticipate potential obsolescence and adjust your investments accordingly.

Conclusion

Devaluates Faster Than NFTs have garnered their fair share of criticism for being speculative and volatile, they often hold value better than tangible assets like electronics, apparel, and vehicles. Understanding the factors that contribute to rapid devaluation can help investors make smarter decisions and protect their portfolios. As the investment landscape continues to evolve, NFTs stand out as a unique case study in balancing risk and reward. By adopting strategies to minimize depreciation, you can ensure that your investments—whether in NFTs or other assets—remain robust and profitable over time.

Discover more about NFT Randomize on TheCrypto30x!